Are You Ready For A New Mortgage Stress Test?

Whether you are looking to be a first time homeowner or purchasing your second or third property, one of the first things you must consider is the mortgage you can get —especially with the new changes in real-estate and home financing regulations.

Typically talking to a mortgage broker should be one of the first steps to consider when buying a home. The pre-approval process will help you gain a better understanding of the price point you should be aiming for based on your finances and approved mortgage amount.

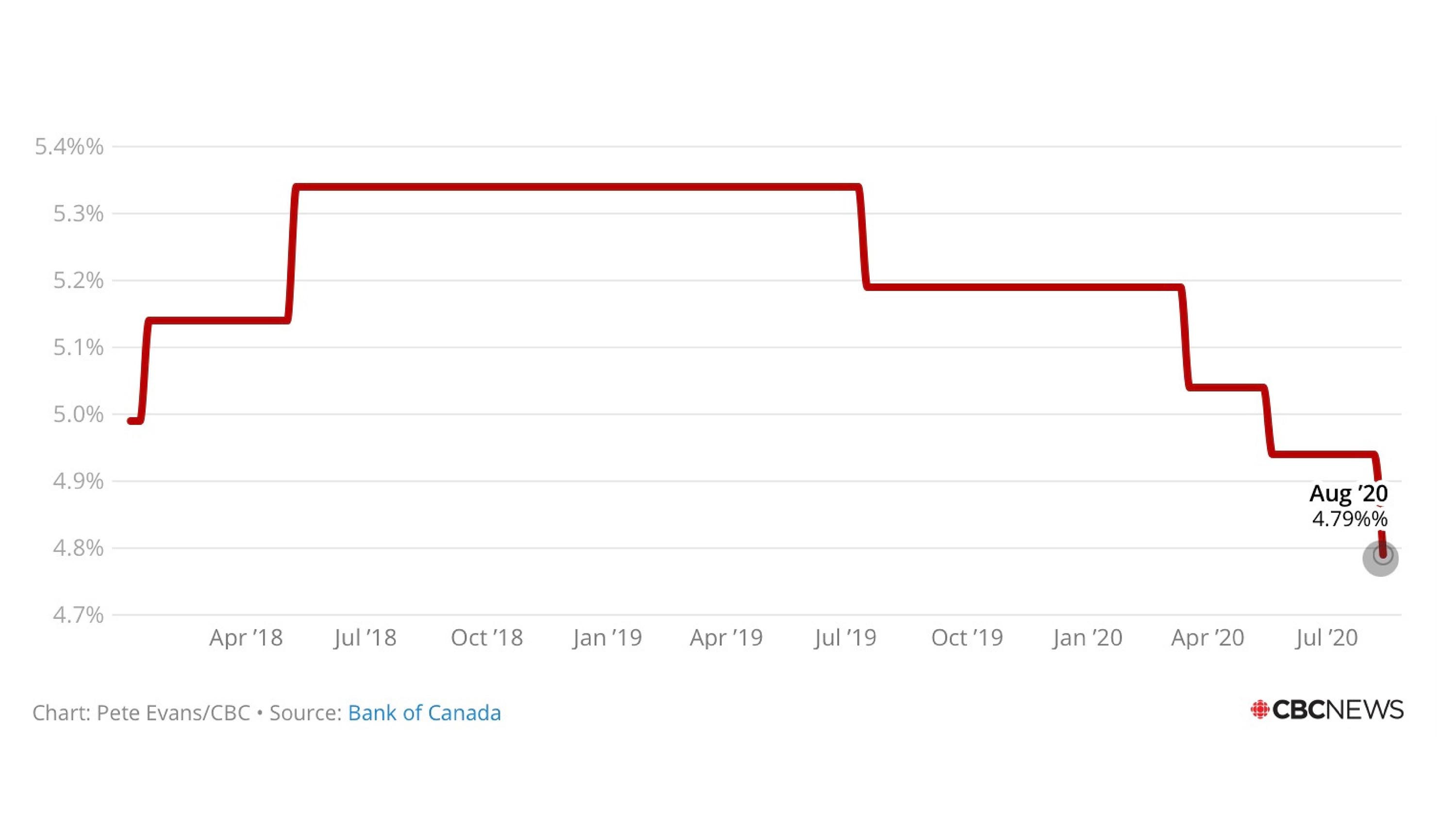

If you haven't heard the news, as of June 1st, 2021, the Office of the Superintendent of Financial Institutions (OSFI) has introduced a new Stress Test. Now, in order to qualify for a loan, you must “pass” 5.25%, as opposed to 4.79% previously..

Will this introduction change the issuance of loans? And will it affect the real estate market in Canada? Let us explore this change further..

What is a stress test?

To qualify for a mortgage from a bank, you will need to pass the stress test. To do so, homebuyers need to prove that they can afford a mortgage at a qualifying rate.

In other words, it tests your ability to handle a loan under various unpredicted circumstances, including:

- Rate change

- Job loss

- Income change

So how does the new stress test actually affect those who are considering taking a mortgage or refinancing their properties? The easiest way to explain this change is by taking a look at a real-life example:

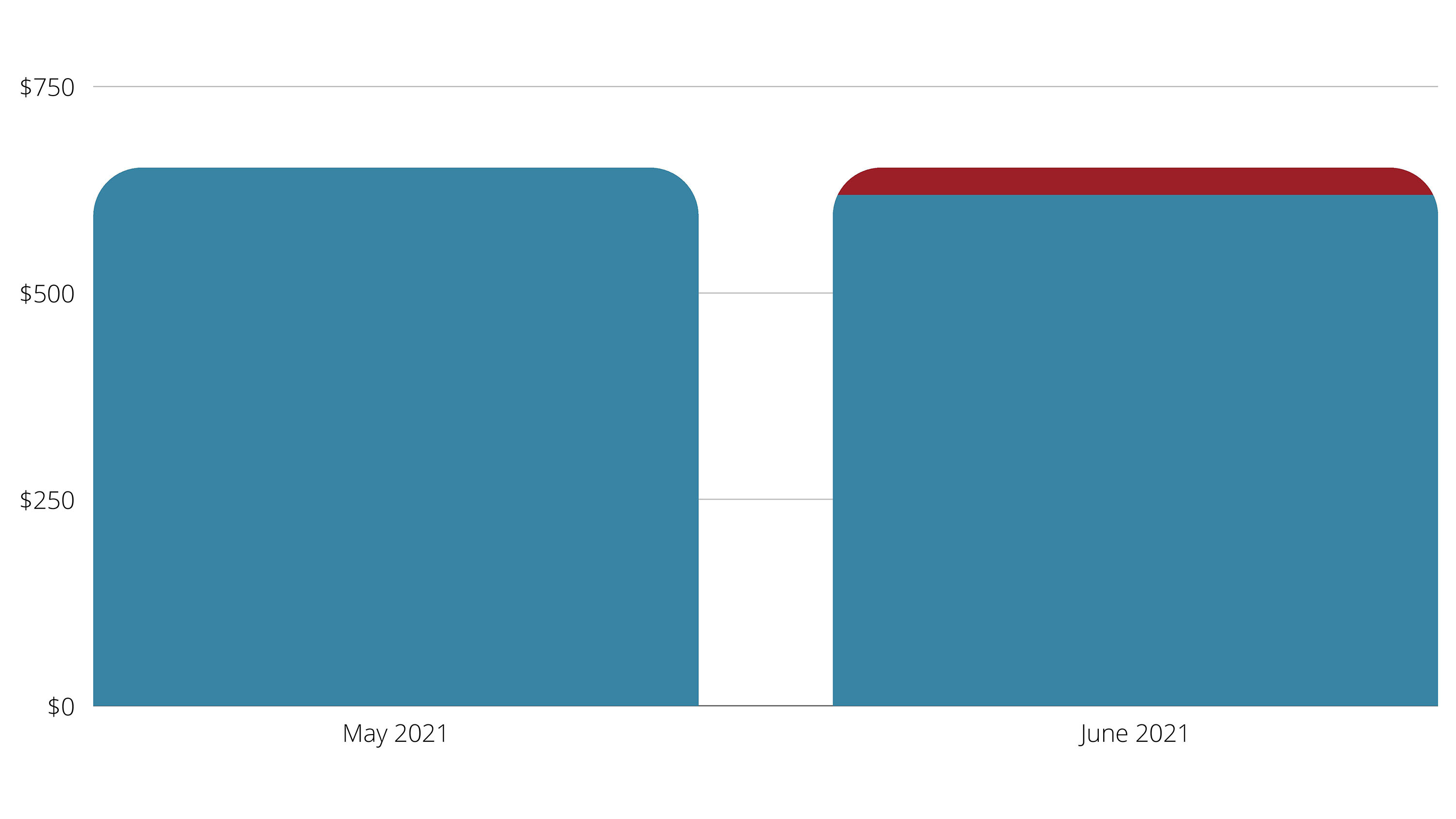

May 2021:

As an example let us consider a family with an income of $100,000 per year, a 20% down payment, and a Stress Test of 4.79%. In this scenario the family will qualify for a $651,000 loan.

June 2021:

Considering all of the above factors remain the same but the stress test changes to 5.25%, the family will be able to get a loan of $618,000.

Under the new stress test, the same client would qualify for $33,000 less mortgage —see chart # 1 below. For some homebuyers, this might mean a big difference, while for others the difference will be negligible.

In any way, it is important to remember that this is not a record high Stress Test. In 2018 and 2019, the Stress Test was at the level of 5.34% —see chart #2 below.

With everyone talking about the news from OFSI,we have already started receiving a considerable number of calls from our clients with questions regarding this topic. So let's answer the most frequently asked questions regarding the stress test.

#1 - My maturity is coming soon. Is a stress test going to affect my mortgage renewal or refinance?

It is important to take care of your existing mortgage 3-4 months before your term ends as you have a better opportunity to review the different renewal options available for you. Yes, changes to the stress test may have an impact on your mortgage rate, but this is all subject to evaluation. That is why it is important to contact your mortgage agent ahead of time.

I have a pre-approval, will a stress test lower my mortgage amount?

Having a Pre-Approval gives clients some confidence in the real estate market when house hunting. However, with the new stress test rules, your pre-approval will be adjusted in accordance with the new regulations.

Considering the scenario above, it is important to contact a mortgage agent for further calculations to your mortgage payment.

I have approximately 20% for a down payment. What should I do?

With access to over 50 lenders, we will be able to find the right product with the right conditions for you. It is not the first time when the regulations have changed, and our team is always here for all your home-finance needs.

Have more questions, visit ikfinancial.com and book a consultation with an IK Financial Mortgage Agent today.

For the latest Mortgage updates follow us on Instagram and Facebook @ikfinancial

READ MORE: